Updated on January 19, 2022

Quality & Features

Excellent

Rates & Fees

Excellent

Month-to-Month & Cancel Fees

Excellent

Transparency

Excellent

Customer Support

Excellent

Reviews:

Great

Save with Square when you take $5,000 or less per month in card payments

Square Payments Review 2022; Square Credit Card Processing Rates, Fees, & Complaints

Dera Joseph | Jan 8, 2022 | Advertiser Disclosure

Square (formerly Squareup) is best known for its streamlined and feature-filled point-of-sale (POS) software, alongside its square-shaped plugin-card reader. However there’s a lot more to this company which will be carefully evaluated in this Square Payments Review. The brand was first founded in 2009 by Jim Mckelvey and Twitter co-founder Jack Dorsey. In 2015, the company went public. By 2018, the company acquired Weebly, thereby expanding its eCommerce functionality.

One of the reasons Square Payments stands out from the crowd is that they provide one of the lowest credit card processing solutions perfect for small business owners. Besides being ideal for low volume processing, Square is also known for its ease of use and simple setup.

Today Square is one of the largest point-of-sales (POS) providers in the world. However, like other merchant providers and credit card processing platforms, Square is not ideal for every kind of business. Whether you are a budding entrepreneur, startup or established small business owner, you wish to choose the ideal payment processor that offers a wide range of benefits, tailored to your unique business environment, Dharma or Payment Depot may be a good alternative. In this square review, we will share with you everything you need to know about what you get with Square; is Square payment good? What services does Square offer? And how Square Credit Card Processing Rates Compare to others?

You will also learn about the benefits and drawbacks of using Square for your business to choose the best merchant account provider and payment processor that caters to all your needs.

What is Square? Is Square Reliable?

Square is one of the best credit card processing companies. They also offer a flat-rate pricing structure but without monthly fees. This creates a predictable pricing and quick setup and alleviates a lot of confusions that small business owners often have when trying to navigate their payment processing rates and fees.

When Square first came to reality, the idea of a swipe-based smartphone processing system with no equipment cost and monthly fees seemed like a fad. But today, Square’s robust and feature-rich suite of products and services is a sweet deal. Think about employee management, a robust mobile app (mPOS), seamless transition between in-store and online selling, recurring billing, online ordering, customer management, in-app inventory and e-Commerce integration, plus a great deal more.

Yes you can enjoy everything that Square credit card processing offers without paying any monthly fee. Most recently, Square also released Square Online checkout which we will talk about in this Square Payments review. Square Online checkout allows you to receive payments anywhere such as SMS text message, email or copy-pasting the payment button online (just like PayPal). So, you can even create a shoppable Facebook and Instagram and collect your payments there without fuss.

Square also offers a free virtual terminal, stored card capability, invoicing, hundreds of third-party integrations and lots more. You will also enjoy a free retain point of sale app, free online store, basic inventory tools and lots more.

There are also no monthly minimums or statement fees you need to worry about. The only difference here is your fee payment depends on the type of transaction carried out. So, you pay a different fee for swiped, dipped and tapped transactions versus online transactions and keyed transactions.

Regardless, Square is most perfect for sellers who want to enjoy payments on the go. And without set-up fees, new business owners can sign up and start processing online, debit and credit card transactions without the need of establishing a processing history.

Square Payments Review; Pros and Cons

Pros

- Great choice for small business owners looking for a simple and easy to understand processing solution

- Ideal for brick and mortar businesses and other low-volume merchants

- Provides affordable chip card readers for small businesses

- Offers a predictable flat-rate pricing

- Software solutions designed by Square to offer more transparency and reliability

- Allows for omnichannel selling

Cons

- Not perfect for large corporations with high volume of transactions

- Not suitable for high risk industries

- No guaranteed Android support

- Comes with proprietary Square hardware which limits flexibility

Who Should Use Square Credit Card Processing Solution?

Square is the perfect choice for every merchant with a lot more value than many other payment processing solutions out there. So whether you are a large conglomerate or micro-merchant, you will benefit from using Square.

Nevertheless Square offers a great and decent deal to small businesses with low volume processing because you can keep your transaction fees predictable and small. Because Square requires no monthly fees, you can also cancel any time, which is great for new businesses and startups. You won’t have to worry about minimum requirements. Anyone can download one of Square’s free apps: they have one for retailers and one focused solely on POS.

However, larger, high volume merchants may prefer a processor that offers the regular lower processing fees with monthly subscriptions and interchange-plus pricing. Square also offers discounts to specific high-volume clients. So there’s room to negotiate your contract. Regardless, as a high-volume business, using this all-in-one payment processor means you might be subtracting processing fees daily which is burdensome. Square is likely to expand their market in the coming years to reach businesses of all sizes; until then, PayPal will be the likely choice for enterprises.

Beyond that, specific kinds of businesses such as mail-order pharmacies, fire-arm dealers and other brands offering high risk products and services may not be allowed on the Square’s platform.

A Snapshot of Our Square Payments Review

Square requires no set up fees, chargebacks, or monthly fee. But there’s more you would learn from this Square review. First off, you must know that Square is more rightly called an entire business ecosystem. You will receive all the tools to run your e-Commerce store, and a lot more advanced POS systems. Think about the free virtual terminal, recurring billing, advanced analytics, free retail POS app, free online store, unlimited items, and lots more.

There’s also the Square for Retail which allows you to enjoy more advanced inventory and reporting with lots more. However, it’s always important to remember that Square is a third-party payment processor. So Square can terminate accounts if it’s risk department decides a merchant bears too many risks. Hence, why Square allows you to quickly open your merchant account, you will be under scrutiny to decide if your business model is too risky.

Nevertheless, a variety of small business owners enjoy using Square because the company has also taken steps to improve its stability. We also recommend that you should read their terms and conditions and understand the general rules governing payment processing to protect yourself and your business as much as possible. The only downside is finding out about why an account was held, frozen or terminated.

Square may also freeze customer accounts if there’s too high a spike in sales with markers for fraud. This is something you need to keep in mind if your business model also provides the chance that you could have quick spikes or growth in sales. But with quick follow-up, this is a small hurdle that can be overcome.

Overall we love that Square offers transparent and affordable pricing, ease of use, and feature-rich suite of tools that is perfect for your business to scale flawlessly. Square offsets some of their fees by making it easier for businesses to succeed financially. When restaurants faced economic slowdowns in early 2020, the company waived the restaurant app’s monthly fee so businesses could budget and recover sooner.

We also love that Square marketing is highly transparent without any gimmicks or promises. The free solutions offered are also entirely free. T

What Merchant Products And Services Does Square Offer

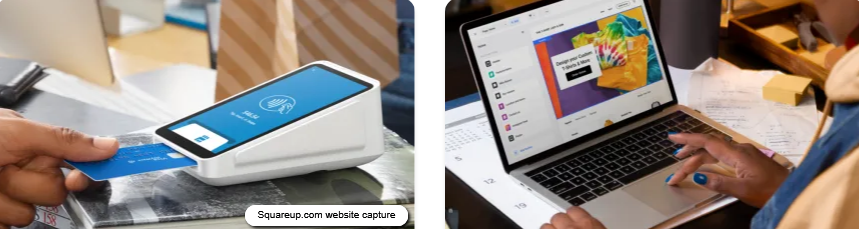

Square POS Apps and Processing

Square’s POS and back-end processing features are unbeatable by every other free mobile processing system out there. The POS apps works well for different kinds of businesses. Upon opening the app, customers see two distinct sections. One section displays product categories, while the other section displays sales information. The app includes the option to pay by cash, credit/debit, gift cards, and Apple Pay. You can even split the bill or tip per your preference.

While you can use Square POS apps, you can also choose to integrate your Square Payments solution with other POS systems such as Lavu, TouchBistro and Vend.

The features you find on the Square POS system are only compared to more advanced and expensive POS solutions on the market. Compared to the lack of monthly fees, you must realize that Square is unbeatable.

Generally, you have four separate Square POS apps to choose from. Each app is designed for a specific niche with a basic free plan available. They include:

- Square Point of Sale: Square POS is the general purpose app and ideal for quick-serve cafes, restaurants and service businesses with moderate inventory and one-staff calendar. This app is free, is available for Android and IOS and works with all of Square’s hardware solutions.

- Square Appointments: this provides an online booking service with the POS system perfect for appointment-based companies such as yoga studios and salons. Here your customers can set up appointments, and you can manage commissions and even sell some products. Square Appointments is also free for one user. But you pay 2.6% + $0.10 per transaction. Paid plans start from $50/month for two to five users and reduced processing fee of 2.5% + $0.10 per in-person charge.

- Square for Retail: This is available for companies with complicated inventories and multi location store management. However, you can sell online, in-person and offer in-store pickup and delivery. The app allows for searching and scanning items with retail-specific advanced reports. Square for Retail works on IPads and Square Register. There is a free plan but paid plans begin from $60/month

- Square for Restaurants: The free plan includes a POS system, team management and customer support. Paid plans offer floor plans, kitchen display system (KDS) for menu management, inventory alerts, kitchen performance and lots more. Square KDS comes with the paid plan that starts from $60/month/location and $40 per additional POS device.

Square Invoicing

Square also provides built-in tools for invoice management. Square’s invoicing tools cover for one-off and recurring invoices alongside installment payments. Square also allows you to create contracts easily with an assortment of contract and invoice templates. That way you can set up default invoice templates tailored with your business information and attach all kinds of files such as images and purchase order to it.

Free Virtual Terminal

Square’s Virtual Terminal allows you to enter credit card payments from your web browser using any internet-connected device. The virtual terminal is absolutely free which is unlike Paypal that charges $30/month for a virtual terminal. Square’s virtual terminal also allows stored card data for recurring payments, if your customers require that service. There’s also support for magstripe readers on Chromebooks and Apple Computers. However, the card reader uses the in-person rate while manually entered transactions require the standard keyed rate.

Square Software Apps for eCommerce Processing

Square is predictable. So you pay a consistent flat-rate, no matter your industry or the card-time. But there’s more. Square is known for its free online store and you can also integrate with other shopping card providers. If you require a more custom set-up, Square’s API makes it easy for your developer to build a custom, PCI-compliant e-Commerce space for your business. You will also love that it integrates with your in-person store, plus dispute management, fraud detection and customer management solutions. Let’s talk about the different dedicated features and tools that Square offers for your e-Commerce business.

● Web-Store Hosting

While you can bring your domain and hosting onto Square, Square offers a free online store powered by Weebly and free hosting. The features are basic but ideal for an entrepreneur who’s just starting out. For a small monthly fee, you can move to your own domain and enjoy advanced features. Besides, you don’t need any coding experience and you will enjoy a mobile-ready store front.

● Square Online Checkout

Square Online Checkout allows you to take payments from shoppers without a full e-Commerce website. This means you can add a payment button to any existing web page, create a shoppable Facebook or Instagram post, or send payment link or text. This feature also provides a QR code system for breaking your shop or outdoor pick-up area into zones. Hence, customers order and pay while your team receives information on where to send the items to, whether by local or instore delivery.

● Payment Gateway

If you already have a website powered on platforms WooCommerce, Ecwid, Magento, WooCommerce, Weebly, and BigCommerce, you can integrate Square payment gateway directly. Other integrations include WordPress.com, Wix, 3dCard, and lots more. The only difference is that the supported features may vary from one website platform to the next.

Square Add-on Services

Square Loyalty Program

Square Loyalty Program comes as an add- service that starts at $45/month with upgrades, after 501 loyalty visits. A loyalty visit is when a customer enrolls on the program or uses the loyalty point on a repeat visit. With this program, you can replace paper-punch cards with a digital loyalty punch for convenience.

Square Payroll

Square Payroll is an incredible feature for managing employee’s sick leave, PTO, tax reporting and lots more. You can also pay and manage your subcontractors using this platform. However, this is an add-on service that starts at $29/month + $5/month per person paid.

Team Management

Square Employee Management Feature is now called Team Management. The free Square team App clocks in and out of your employee phones and allows you to track and calculate paid and unpaid breaks alongside overtime. Team Plus gives you a lot more including early break clock-in prevention, multiple wage rates and lots more at $35/month

Square Capital

Like other merchant account providers, Square also provides Square Capital to provide business loans as soon as the next business day. What you will love about this is having to pay back only a fixed percentage of what you process which is flexible.

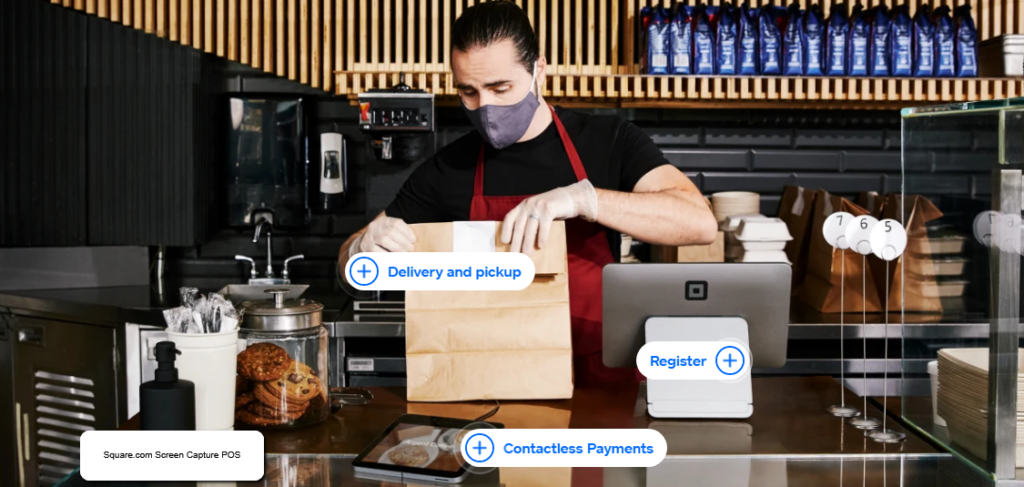

Square Hardware

Square provides a lot of options to choose from including bundled POS kits. However, let’s talk about the most notable Square hardware for you. Even so, Square has put in place a financing option for hardware costing over $49. This allows you to start using their hardware with lower investments and pay back within a stipulated period of time. Regardless, financing depends on your credit check and will vary from one state to the next. One thing we love about this is that you can decide to purchase or use Square Event rentals with reasonable prices.

Magstripe Card Reader

Square offers a basic Magstripe Card Reader that is entirely free. But if you want the variants with Lightning and 3.5mmheadphone jack, you will pay $10.

Square Contactless & Chip reader

This comes with a free basic magstripe reader but the chip reader costs $49. Additionally, Square offers two all-in-one POS devices with built in card readers called Square Terminal and Square Register.

Square Register

Square Register is a custom Android hardware that runs the Square POS. Square Register also works with the free version of Square for Restaurants and Square for Retail. The set-up includes a 13.inch screen device with a 7-inch customer-facing display. It also supports EMV, NFC and magstripe payments. However you must purchase other hardware such as a cash drawer, and receipt printer separately. On its own, Square Register costs $799. But with Square Register Kit with USB receipt printer, USB cash drawer, and receipt papers cost $1, 329.

Square Terminal

If Square Register seems too much, you can choose this hardware solution. The Square Terminal is a small credit card terminal with a smartphone sized screen. It comes with a built-in receipt printer, and integrated card readers for contactless, chip card and magstripe transactions. It is also battery-powered, allowing you to plug and use or use entirely wireless. Square Terminal costs $299 but you can finance at $27/month for 12 months. However, your payment processing rate here is 2.6% +$0.10. Square terminal also integrates with Restaurant POS which improves your ordering process.

Hardware and Software Requirements

Square is more suitable on the IOS platform than every other device. So, you must always use devices running on the latest IOS version. This does not mean you cannot use Android devices, but there’s no guaranteed support for those. If you must use android, the device must run on Android 5 or higher.

Other reasons to choose Square Payments

Swift Payouts

Our Square review will not be complete without helping you realize how long you would have to wait to receive your funds from Square. Generally, you can have your funds deposited to your merchant bank account in one to two business days.

If you wish to receive your funds faster, you can opt for instant or same-day deposits of 1.5% of the transfer amount. Recently, Square provided the Square Card, which is a Mastercard debit card that allows you to access your funds almost immediately without requiring bank transfer.

Card on File

Square’s Card on File Feature allows you to store your customer’s card information safely and securely if your customers require such service. Since Square hosts your customer data, you don’t have to worry about payment security. You will remain PCI-compliant and everything is entirely secured using state-of-the-art security protocols. Offering this service is a sweet spot. This allows your customers to continue paying for new orders without having to pull out their cards. This feature works with the virtual terminal, e-Commerce, and Square Invoices. However, you will still pay the standard keyed-entry rate for this feature which is higher than the in-store rate. But the convenience and simplicity you offer your customers will be worth it as many customers would like to cut down their payment journey with this service. Again, these card details will be available via multiple channels, while still being thoroughly secured.

Customizable Dashboard

Square’s Dashboard is incredibly customizable so you can focus on the information that is most important for your business. You can customize the dashboard by dragging and dropping different widgets. Here you will enjoy real-time sales data on your IOS device among other functionalities .

Customer Database Management

Square offers a robust customer database where you can save card data, names, contact information and lots more. You can also track customer behavior, sales, customer visit frequency, and lots more. It’s also possible to segment your customers into groups for personalized marketing campaigns. The greatest past, your customer database is available for free.

Advanced Reporting

Square also offers advanced reporting for free. You can generate real-time reports by the hour, day, week or year. You can also focus on particular categories and all reports are exportable. More specialized reports with focus on retail and restaurants are provided using their dedicated POS systems.

Inventory Management

Square’s basic inventory management is incredibly robust for a monthly processor without monthly fees. However, it’s still basic and a step behind what you get with the Square for Retail app. On the basic app, you will enjoy item categories add-ons, online and in-store inventory syn, bulk inventory import/export and management, stock alerts and lots more. Square also supports inventory integrations if you require a more robust inventory management solution.

Multi Location Management

At the free level, you can manage all your locations through a single account. Here you can also adjust your pricing, inventories, employee data and lots more.

Installment Payments

Square Installment feature is an excellent choice you can offer your customers. This is the ‘Buy Now, Pay Later’ feature that has begun to trend in recent years. So as a merchant you will receive your funds upfront while Square Capital assumes the collection of payments from the customer.

Gift Cards

Square also allows you to use a pre-designed or custom card to offer gift cards to your customers. There’s no redemption fee and you can reload the card. There’s also analytics to track how customers spend the gift cards. You can also email the online gift card. The only fee you pay is the regular processing fee once the card is used.

Customer Feedback

You will also love that Square prompts customers to leave their feedback with you directly (and not on your social media). That way you can manage your reputation, identify problems quickly and prevent nasty complaints from surfacing. You can also issue coupons and refunds to your customers directly from Square Feedback without any extra charges.

Email Marketing

Square also provides free basic email templates to help you engage your customers. However, if you wish for more, such as sending unlimited emails, automated email campaigns and coupons you need to pay a monthly fee.

Widespread Coverage

Unlike Paymentdepots.com, Square has started expanding beyond the US. Right now, the payment processor supports merchants in Japan, Canada, United Kingdom, and Australia. However, do bear in mind that the pricing and payment methods may vary from one country to the next.

Square Pricing: How much does Square Charge?

Square Pricing set-up is pretty simple. The only complication depends on if you are choosing more robust features for instance the Square for Retail POS app. But at the bottom line your payment processing rates are consistent and you won’t pay any extra fees whether you process JCB, UnionPay, American Express, Discover, Visa, or Mastercard.

Square Payment Processing Rates

- Keyed-in or Card-on-File transactions:3.5% + $0.15

- Square Online Checkout:2.9% + $0.30

- Square Point of Sale (with any mobile card reader):2.6% + $0.10 per tapped, dipped, swiped transaction

- Square Register & Square Terminal:2.6% + $0.10 per tapped, dipped, swiped transaction

- Square for Restaurant POS: 2.6% + $0.10 per tapped, dipped, swiped transaction

- Square for Retail POS: Free plan comes with 2.6% + $0.10 but the plus plan offers 2.5% + $0.10 per tapped, dipped, swiped transaction

- Square Appointments: For individuals, you pay 2.6% + $0.10 per tapped, dipped, swiped transaction. For teams, the cost is 2.5% + $0.10 per tapped, dipped, swiped transaction

- eCommerce Invoices & Transactions:9% + $0.30

These fees differ from one country to the next. For instance, Canadian merchants can use the Interac Flash debit at the cost of $0.10 per transaction and for credit transactions 2.65% per tap, swipe or dip.

Overall, merchants have a transaction limit of $50,000. If the purchase price exceeds this figure, Square suggests splitting payments into installments. However, some Square Complaints on BBB stated differently. It seems the threshold is more realistic at $3,000. We have seen complaints that transactions above this range triggered suspensions and terminations.

Square Monthly Services

Square’s advanced POS apps and features require monthly fees. Here’s a breakdown of what you get on Square for using them.

- Square Payroll: $29/month + $5/month per contractor or employer paid

- Square for Restaurant: Starts with a free plan. Plus plan begins at $60/month per location (Additional POS is $40/month)

- Square for Retail: Starts with a free plan. Square for Retail Plus begins at $60/month per location.

- Square Appointments: Free for individuals; $50/month for two or five employees, $90/month for six to 10 employees

- Email Marketing: $15/month for 0 – 500 targets; $25/month for 501 – 1000 targets; $35/month for 1,000 – 2,000 targets.

- Team Management: Starts with free plan, Team Plus starts at $35/month/location

- Loyalty: $45/month for 0-500 visits, $75/month for 501 – 1,500 visits and $105/month for 1, 501 – 10000 visits

- Gift card: Batch of 20 costs $2/ per card. Quick Card in a batch of 75 goes for $1.20/per card. Custom designs begin from 75 in a single batch at $1.75 per card and decrease as you order more.

How Square Credit Card Processing Rates Compare?

Square is more than just a payment processor. Very free mobile processors offer lower rates plus a compatible POS and e-Commerce system in one. This is definitely the best reason to choose Square above others because set-up is easy without too many integrations. However, if you begin processing higher volumes or larger transactions, getting a merchant account would provide more stability. But for new merchants, seasonal and low-volume businesses the value-added services offered by Square is worthwhile.

You will also love that there are no locked-in contracts or early termination fee. For the add-on services with monthly payments, you will have a 30-days free trial to try them out. But you must wait the full 30 days before cancelling or renewing your subscription. You will also enjoy a 30-day free trial for the hardware without any penalties if you return the hardware.

Square Customer Service and Support Channel

Customer loyalty is a major concern among many small businesses, as is scaling for growth. Square helps anticipate these needs with services like invoicing, feedback portals, and other customer management tools.

First off, their knowledge base is comprehensive. On their blog (known as Townsquare), you will find hundreds of articles targeting businesses and merchants of all types. So you have plenty of articles helping you learn how to use Square tools to maximize its benefits for your business. The company also does a decent job of addressing customer service complaints on all of its social media channels.

Positive and Negative Square Reviews

Frequently Asked Questions About Square

The Verdict

You get easy access, a friendly interface, and a quick payment system with Square. You can find cheaper alternatives, but you will likely have more setup and day-to-day maintenance. You’ll also struggle to find the same ease-of-use for less.

Businesses are looking to scale their eCommerce presence and most enterprises might look elsewhere. Still, Square works well for those starting a new business: employers can quickly train staff to use Square. Mid-sized businesses may find it worthwhile to pay the extra fee for inventory management across multiple locations. The possibilities are endless!