Updated on January 19, 2022

Quality & Features

Excellent

Rates & Fees

Excellent

Month-to-Month & Cancel Fees

Excellent

Transparency

Excellent

Customer Support

Excellent

Reviews:

Outstanding

Save with Square when you take $5,000 or less per month in card payments

Payment Depot Reviews ( 2022) – Features, Pricing, Comparison & Complaints

Dera Joseph | Jan 2, 2022 | Advertiser Disclosure

Our Payment Depot reviews allows you to gain refreshing insights on this flat-rate payment processor. But one thing we love is that Payment Depot stands out from a crowd of merchant service providers for its easy-to-understand payment strategy, no contracts, no chargeback fees, hidden fees, and overcharging.

It is a merchant account provider that offers the interchange-plus pricing structure and charges for transactions based on your plan and not the terminal you use. This means it is a membership-based or flat-fee payment processor.

A lot of merchant payment depot reviews are also about the 90-day hassle-free, obligation free trial. So if you cancel your merchant account before that window elapses, it will refund your annual membership fee. Payment processing also stands out because of its list of features; free virtual terminal, next-day funding, risk monitoring, low chargeback, rate protection, and mobile payments.

Presently the company processes over 3 million transactions every month, to the tune of $4 billion annually making the company among the best merchant account providers. It’s no wonder, major corporations like Dominos, Subway, and Sprint use this payment processor. The company is also headquartered in Orange, California, and has been around since 2013.

However, there’s more to making the proper choice of a merchant service provider than its history.

No matter your business size, type, or average order value, you want to secure the lowest rates possible, with excellent customer service and equipment.

So, in this guide, we will walk you through the features, products, and services, payment processing fees, reasons to use this payment depot payment processor, payment depot customer reviews, and lots more. In the end, you can decide if this is the ideal payment processing solution for your business or not.

What is Payment Depot Payment Solution?

At its core, Payment Depot is a front-end processor. This means it helps your business accept credit card payments from your customers, by connecting you to credit card networks, authorizing and making settlements to your merchant account.

Payment Depot allows you to process American Express, Discover, Visa, and MasterCard credit and debit cards. You can also accept echeck and ACH payments. What you will mostly love about this payment processing service, is that they will deliver processed payments to your account

It is worthy to note that Payment Depot uses First Data and TSYS for its back-end processor. Signing up on Payment depot payment solution sets your merchant account with TSYS or First Data. You will get a First Data account if you use Clover POS.

Payment Depot Merchant Services Pros & Cons

Pros

- All-in-one membership for in-store, online, and mobile processing

- Flat-fee credit card processing solution for high-volume merchants.

- Compatible with many popular e-commerce platforms and POS systems.

- Easy to understand payment pricing

- Risk-free trial for 90-days. Your annual membership fee will be refunded if you wish to cancel within the 90-days window.

- Transparent month-to-month billing

- No unnecessary fees, confusing terms, and high markups

- No setup or application fees

- Excellent customer support

- Reprograms your existing terminals for free

- Very few payment depot complaints

- Includes PCI compliance

- Comes with a Free virtual terminal for entering credit card numbers

Cons

- Does not accept high-risk businesses

- Challenging to deal with chargebacks

- Memberships have maximum processing limits.

- Not ideal for low-volume businesses

- Only accepts US-based merchants

Who Should Use Payment Depot – Best for High volume businesses

Payment Depot is one of the best merchant service providers for small businesses. After evaluating various merchant services and payment processors, we can rightly say their claim to honesty and transparency beats the others. As a front-end processor, Payment Depot is suitable for B2B, mobile, e-commerce, medical, legal, accounting, retail, restaurant, and professional service businesses.

It is especially ideal for high volume, established, and mid-sized businesses using virtual terminals because you can enjoy a wide variety of third-party virtual terminals compatible with restaurant and retail businesses. Examples of businesses that can use Payment Depot include busy restaurants, healthcare providers, fast-food chains, and e-commerce companies.

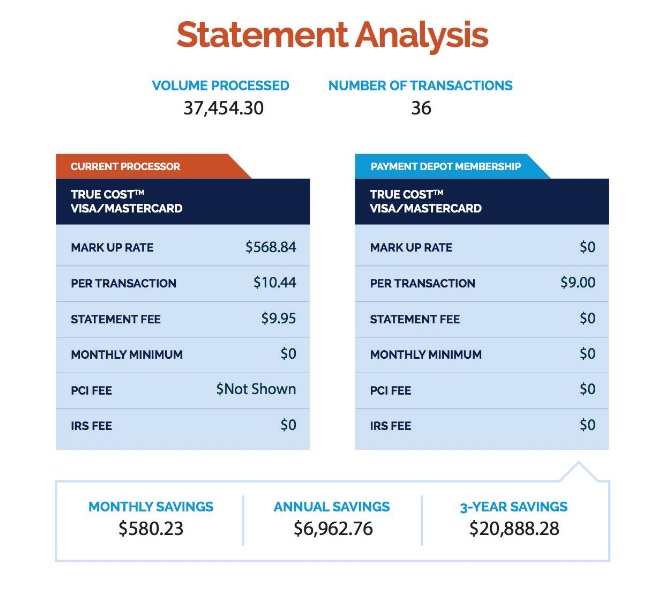

With the high volume, you can gain up to 40% savings on processing costs. Payment Depot is also one of the cheapest credit card processors especially when you factor in the transparent fees.

However, if you are a business looking for a pay-as-you-go model such as a new and low-volume or seasonal seller, this isn’t the payment processor for you. Payment processors are not also open to high-risk merchants. There’s also no native mobile point-of-sale (POS) solution, but Payment Depot covers this hiccup by integrating with SwipeSimple for its mobile processing.

The only downside to this front-end processor is that it is only available for merchants in the US. Overall, Payment Depot is suitable for many kinds of businesses. Think about the savings you can gain on processing fees, and that’s the sweet point.

A Snapshot of Our Payment Depot Review

Your payment processing fees will heavily influence the best payment processing software for you. This is notwithstanding the size of your business, average order size, and type.

We carefully reviewed diverse payment depot customer reviews to ensure you have the appropriate information to make the best choice.

The best thing we love about the payment depot is its transparency and the fact that it is a flat fee payment credit card processing solution. They are also known for their prompt customer service and low processing rate. You will especially love their credit card processing fees. The only complaints about Payment Depot review seem to be new and startup businesses selecting Payment Depot for its flat-fee structure. Payment Depot is best for businesses that would benefit from its cost savings. If you are a seasonal business, a flat fee might be too steep except you are making high-ticket sales. However, you will love that the fees you pay don’t vary whether it’s chip transactions or online transactions.

Again, the company boasts of a professional-looking and easy-to-navigate website. You will also love the full disclosure of the cost of using this service, which is unlike many other payment providers. However, the only downside is that there is a knowledge base on their website. Even the graphics and charts you find there are oversimplified. Regardless, their pricing structure remains precisely the same.

Following a thorough review of all payment depot complaints and positive reviews, we can rightly say that depot payment is a suitable payment processor for a great merchant account.

What Merchant Products and Services Does Payment Depot Offer?

Merchant Account

As said earlier, Payment Depot is not a direct processor. Signing up gets you a merchant account on TSYS or Fiserv (formerly First Data). However, Payment Depot will handle the setup and manage your account. But occasionally, you may work directly on your back-end processor. If you are using the Clover POS line, you will be placed on Fiserv, if not the choice is TSYS. Nevertheless, merchant accounts offered by Payment Depot are dedicated which means your account will not be subject to freezes and account holds which is common with other aggregated merchant accounts like PayPal.

Payment Depot Credit Card Terminals

Payment Depot brings to you a wide variety of standard terminals from SwipeSimple, PAX, Dejavoo, and Ingenico. These terminals can accept magstripe, NFC-based, and EMV payments. You can purchase these terminals with a software and warranty to connect your merchant account to the processor’s transaction processing network. Here are some of the terminals you can purchase:

- Vital Plus ($449): This terminal accepts contactless payments, chip cards, and magstripe. It also scans barcodes and prints receipts.

- Clover Mini ($599): This scans barcodes and prints receipts. It also accepts chip cards, magstripe, and contactless payment methods.

- Clover Flex ($499): Comes with a built-in receipt printer. It also accepts chip cards, magstripe, and contactless payment methods.

- First Data FD130 ($299): This is a countertop card reader for accepting chip cards, magstripe, and contactless payment methods. It also prints receipts.

- Dejavoo Z11 TriComm ($299): Accepts chip card magstripe and contactless payment methods.

- Poynt Smart Terminal ($599): A wireless card reader accepts chip cards, magstripe, and contactless payment methods. It sends text/email receipts and prints receipts.

- VeriFone VX520 ($299): A countertop card reader that prints receipts and accepts chip cards, contactless, and magstripe payments.

Payment Depot Smart Credit Card Terminals

Smart virtual terminals are terminals that offer feature-rich touchscreens and allow you to install a variety of apps including inventory management. You can choose from Vital Plus, Poynt Smart Terminal, and Clover Flex. One thing you would love is the flexibility that you get to use a variety of hardware solutions for a single monthly fee.

Point of Sale (POS) Systems

Payment Depot provides the full line of Clover POS systems from Fiserv (including Clover Station Pro, Clover Mini LTE, and Clover Station). You can also choose the Vital Select POS system if you are onboarded with TSYS/Global payments. The best two POS solutions offer:

- Vital Select ($1,399): The Vital Select POS system allows mag stripe, chip, and contactless payment. It is a 15.6inch touchscreen device that comes with a customer-facing display, receipt printer, barcode scanner, and attached cash drawer. This POS system also provides functionalities such as customer relationship management, tax administration, inventory management, pricing discounts, and employee management

- Clover Station ($1,499): The Clover Station is a 14-inch touchscreen device that comes with a customer-facing display, receipt printer, and cash drawer. It also supports contactless, card, and magstripe payments. Your software will depend on the pricing plan you choose. You can choose the Register Lite ($14/month) or Register ($29/month). Whichever you choose, they come with functionalities to set employee permission, track sales, and reports, process payments offline, use the Clover App market, and manage inventory.

Mobile Payments

Payment Depot offers a third-party SwipeSimple app and compatible hardware for mobile processing. You can download the app from Android and IOS and it works on both tablets and smartphones. Presently, Payment Depot offers SwipeSimple B250, an amazing mobile processing solution that connects using Bluetooth and accepts magstripe, NFC-based, and EMPV payment methods. It’s also possible to use the BBPOS Chipper 2X BT card reader and connect via the Authorize.Net gateway through Windows computers. At the base, you can get the card reader for $69 without a Bluetooth connection. However, the SwipeSimple Bluetooth contact reader costs $79.

Virtual Terminals

You will love that Payment Depot brings to you a free virtual terminal that works like a credit card terminal through your existing windows computer. This virtual terminal allows you to key in transactions manually. You can also use the optional BBPOS Chipper 2X BT card reader for swipes or dips.

Payment Gateways

Payment Depot integrates a variety of payment gateway and the most popular choice is Authorize.Net. You will love that your gateway fees may be included in your monthly membership fee. Again Payment Depot is also compatible with a variety of e-commerce platforms however this varies for the different payment depot pricing plans, so you need to confirm before signing your agreement.

Business Funding

You will love that Payment Deport also offers merchant cash advances or loans for businesses requiring extra money right away. It’s also possible to receive your money in 24 hours minimum. However, ensure to review your repayment terms and requirements. This loan is available up to $500,000 and repayment terms max at 18 months. There are only a few clauses that might make your business eligible for this scheme. First, the business owner must have a personal FICO credit score of at least 500 and minimum gross monthly revenue of $15,000 for the last three months. Also, the business must have been operating for at least six months before requesting funding.

Other Features and Reasons to Use Payment Depot Credit Card Solutions

Flexible hardware

All terminals you can get through Payment Depot are not proprietary tools. This means you can either choose to purchase through Payment Depot or reprogram your existing equipment for free. This gives you a great degree of freedom and flexibility. It also adds to the company’s transparency. That way you can never feel as though you are being locked into an account or contract.

Next-day funding

Payment Depot boasts of the capability of sending your funds to your merchant account after 24 hours for every transaction. However, do realize 24 hours does not mean that the sales made at the end of the day will be sent in the morning hours. We’ve seen some merchants complain about this because of the misconception. Your 24 hours next-day funding logically and rightly works as 24-hours per transaction. You can also easily keep track of the funding process by checking your Payment Depot dashboard.

Money-back guarantee

There’s no doubt that Payment Depot stands out because of its money-back guarantee. Think about having up to 90-days which is 3 months to test-run a software to ensure it’s the perfect choice for your business. Plus, you can cancel without any penalties.

Online integrations, Compatibility and Payment Options

Payment Depot also offers online shopping integration, eCheck (ACH) processing, and developer tools for web designers. However, you need to confirm with your sales representative, if they are available for your payment plan and business. Regardless, Payment Depot can process all major credit cards, alongside mobile wallets, including Apple Pay and Android Pay. You can also use this payment processor with many popular small business e-commerce tools like Freshbooks, and Shopify.

Payment Depot Pricing: How much does Payment Depot Charge?

Starter Membership

- Monthly fees: $79 per month

- Transaction fees: Interchange + 15 cents per transaction

- Monthly processing volume limits: $50,000

Starter Membership comes with a free virtual terminal, free basic terminal or mobile card reader, and access to Authorize.Net gateway.

Most Popular Membership

- Monthly fees: $99 per month

- Transaction fees: Interchange + 10 cents per transaction

- Monthly processing volume limits: $150,000

This is Payment’s Depot mid-level membership plan suitable for established omnichannel brands. Included in your plan is data breach protection. However, there’s no mention of virtual terminals, payment gateways, or smart terminals. You need to contact Payment Depot support to confirm the features you can access with this membership plan.

Enterprise Membership

- Monthly fees: $199 per month

- Transaction fees: Interchange + 7 cents per transaction

- Monthly processing volume limits: $300,000+

Enterprise plans are suitable for very large businesses. It offers the lowest processing rates with data breach protection and a dedicated account manager for support and customer service. Your plan may also include a free premium gateway and Clover Mini terminal, but you need to contact sales to ensure those products are available. Payment Depot also provides custom-priced plans which can be required by sending an email or contacting the sales team.

We recommend that you purchase annual membership plans instead of monthly plans. This allows you to save up to two months of subscription fees for over a year plus Payment Depot’s 90-day risk-free trial to check out if it’s the perfect choice for your business.

Regardless, even if you decide to cancel your Payment Depot membership but retain the terminal you can do so, but must purchase it outrightly. If you decide to return it, you may have to pay a 20% restocking fee. Plus whether you accept swiped, tapped, dipped, keyed-in or online transactions, you still pay a flat fee.

Additional fees

Payment Depot does not charge any other fees for items such as setup, cancellation, junk, or termination fee. There are no long-term or minimum contract terms as well. If ever you need new hardware, Payment Depot may provide this equipment for free or reprogram your existing terminal for free. You can also purchase new equipment beginning from $49 or use its free key entry virtual terminal which enables you to accept keyed-in card payments across all web browsers.

Nevertheless, you may also encounter occasional fees such as credit card network fees and assessment alongside chargeback passed along to you through your processor. We recommend that you review your merchant agreement for such details. Payment Depot may also charge a monthly PCI non-compliance fee of $19.00 if your account isn’t compliant.

Payment renewal, contract, and termination fees

Overall, you don’t have to worry about automatic renewal clauses as Payment Depot does not enforce any long-term contract and early termination is free. Regardless, it is still diligent to review your agreement before signing with any provider.

In the same vein, the company does not require advance notice to cancel your account. However, if you already run transactions within that month you’d like to cancel, Payment Depot immediately processes the cancelation and schedules actual closure which becomes effective at the end of the month to ensure the current month’s fees are collected.

Again, customers may have up to 120 days to file a chargeback, so your account may not be fully closed until 120 days from the date of your last transaction. However, you won’t be charged any monthly fee during that period.

Choosing the Right Payment Depot Pricing Plan

The best Payment Depot plan depends on your business. So you need to evaluate the average number of transactions you process a month alongside the average transaction size.

That way, you can choose the best membership plan suitable for that plan. Regardless, if your business outgrows your current plan, you can easily switch to the next highest plan.

How to Get Started With Payment Depot?

It’s so easy to sign up on Payment Depot. You can do so by filling a form on its website or speaking to its team via phone. Your initial application requires less than 10 minutes. After which, you will receive an email link to complete your application.

There, you need to provide:

- Voided business check

- Federal tax ID number

- Physical business address

- Social Security number

Once done, you may receive approval in as little as 24 hours and start accepting credit card payments in just 2 days. Regardless, don’t forget that some merchants with higher average tickets and longer delivery time-frames may have to provide previous processing statements and bank statements during the application.

Payment Depot Support; Payment Depot Phone Number Support

Payment Depot appears to offer a 24 hours, 7 days a week support team. However, as with every other brand, you would likely get the best support service if you call during business hours from 8.00 AM to 5.000PM Pacific Time. The only drawback is that they don’t offer chat-based customer service. You only have to call or send an email. Again, depending on your payment plan you may have a dedicated account manager. Regardless, some technical support issues will involve its processors (TSYS) or Fiserv). Nevertheless, Payment Depot currently only boasts of a basic FAQ but the brand lacks a knowledgeable base which would be preferred by a lot of customers. Overall, most customers on Payment Depot claim that the company is quite good at providing superb customer support.

Payment Depot Reviews; Payment Depot Complaints, Positive and Negative Reviews

Following our review of diverse online review channels including TrustPilot, we can say that Payment Depot does an amazing job. The company is also accredited by the BBB and has an A+ rating. On Trustpilot and Yelp, a handful of Payment depot complaints can be found from a few years ago. The majority of complaints we see are concerning businesses that are often too small or high risk to use the processor. However, it’s also amazing that Payment Depot takes time to respond in detail to every complaint. The company also admits mistakes when it happens and issues refunds when appropriate. The only other downside to this amazing payment processor is the limitations for international and high-risk businesses.

However, the majority of reviews about the company are positive. You can also check out their video testimonials on the company’s YouTube channel.

How does Payment Depot compare to other credit card payment processing fees and solutions?

Payment Depot vs Clover

Payment Depot offers a flat pricing based structure which is a more satisfactory deal compared to an alternative like Clover. However Payment Depot’s monthly fee is much higher but compared to the transparent fees, our Payment Depot reviews shows it’s a more satisfactory option.

Payment Depot vs Square

Payment Depot and Square offer attractively low flat-rate credit card processing fees. However, Square also offers same-day or instant funds receipt but at a significant extra cost. In contrast, Payment Depot offers 24-hour fast approval for each payment processed. Square may take up to two days if you don’t want to pay the extra cost. Regardless, Payment Depot is a solution ideal for U.S merchants. Square is more open to merchants around Japan, Australia, and the United Kingdom. Nevertheless, Payment Depot varies and stands out from Square in that it is best for high volume businesses who would benefit from their lower transaction fees.

Payment Depot vs Stripe

Stripe is a much lower option for any business willing to accept payments online. In contrast, Payment Depot serves a variety of businesses accepting credit card payments.

Frequently Asked Questions About Payment Depot?

What is Paymentdepot.com?

Payment Depot is one of the best-known flat-fee credit card processing solutions. This is because you pay a flat membership fee (subscription-based debit/credit card processing) that does not fluctuate. A lot of merchant payment depot reviews we evaluated shows that this is a satisfactory solution for high volume businesses.

Who owns Payment Depot?

Payment Depot founder and president is Danny Choi. The brand remains the pioneers of the membership pricing model offering wholesale credit card processing fees for both online and chip transactions.

How long has Payment Depot been in business?

Payment Depot credit card processing company has been around since 2013. Today the company is one of U.S largest wholesale credit card processors offering business credit cards solutions, chip transactions among others. The company now processes over $4 billion per year.

What percentage does Payment Depot take?

Payment Depot offers a flat membership fee plus a flat fee per transaction depending on your membership plan. The wholesale interchange rates are set by the credit card networks.

Does Payment Depot have a mobile app?

Payment Depot uses the SwipeSimple mobile app which enables you to process mobile transactions with ease. This isn’t a native app but it’s equally a sweet collaboration. On this app, you can see your sales, inventory, past transactions, invoicing, and tax calculations.

How to negotiate credit card processing fees on Payment Depot?

Payment Depot offers a flat-fee system. This means you may not be able to negotiate your payment processing rate. However, huge businesses such as e-Commerce brands and fast-food chains have just the right volume to negotiate lower rates. For such businesses, Payment Depot is simpler and cost-effective.

How do interchange fees work?

Generally, payment processors charge an interchange fee. This is a fee owed to the credit card network for each transaction plus a smaller percentage markup to the processor running the transaction. However, Payment Depot does not charge the standard percentage markup. In its place, you are paying a small fixed fee. Therefore, your transactional fees would be the small fixed fee plus what is owed to the credit card network. This kind of fee structure is called wholesale interchange pricing. And as you know, this is one of the cheapest pricing structures in the payment processing industry.

Do my monthly fees cover chargeback fees?

No, chargeback fees are entirely different from Payment Depot’s membership plan. However, they also have one of the lowest chargeback fees at an average of $15. You may also pay additional fees for PCI compliance if your business fails to follow the rules.

Will Payment Depot save my business money?

Payment Depot saves a great number of business money in terms of credit card processing costs. But it varies for online transaction thresholds. If you deal with larger and higher volumes of transactions, it will save you the most money.

The Verdict

Having Payment Depot as your payment processor might be an excellent idea. This is one Payment Processor that lives up to its name in reliability and transparency. There are only a select few flat-fee credit card processing merchants out there. You will also love that the transaction rates are just low giving you opportunities to save on processing costs as long as you are a high-ticket or high-volume business. For most medium and high-volume businesses, Payment Depot’s membership fees are more than paying their current payment processor’s interchange fees. So if you are a business that processes up to $10,000 per month, you will love this processor. Additionally, you don’t have to worry about being locked into any long-term contract, paying steep termination fees, set-up fees, and others.