Updated on January 7, 2022

Just like a business owner, you work hard to earn each dollar and when it comes to software, a penny saved is a penny earned, and the free software is the goose that laid the golden egg!

However, when we come across the word free, we would be excited but our inner voice would scream “it’s too good to be true!” most time free means fishy, unreliable. So can the free bookkeeping software really exist when entrepreneurs, freelancers, and small business owners around the world pay good money every month for accounting and invoicing software?

It can and it definitely does. There is nothing more because we have taken time to research and also evaluate the free bookkeeping tools which are available for you. Ensure you continue reading in order to get more information about the best free accounting and invoicing software.

Best Free Accounting Software

Winner: Wave

“Real accounting for non-accountants”- this is a very catchy slogan for sure, and CPO James Lochrie and Kirk Simpson who is also a CEO have a close thought when they created Wave in the year 2009. Since that time, Wave has caught the eye of huge investors, charmed industry experts as well as press who have given Wave this title “Best Free Accounting Software For Business.” Right now, we have about 1.5 million users in over 200 different countries.

- Cloud-based software can be accessed from anywhere and at anytime

- It has simple and easy to use interface

- It can be set up quickly

- Ability to create beautiful invoices – simple to make, with three templates to choose from, customizable with logos and colors; can set payment reminders and accept payments straight from the invoice

- It can convert estimates to invoices with a single click

- Includes nine accounting reports

- Keeps track of receipts, quick input with the mobile app Receipts by Wave

- Automatically imports and categorizes bank, credit card, and PayPal transactions

- Free personal accounting alongside business accounting

- Set sales tax(es) with ease

- Other functions include: journal entries, bill and invoice reminders, and expense tracking

- Scalability – as your business grows, the Payroll plancan be added for $19/month

- Integrates with PayPal, Stripe, and more

- Multi-currency options

- 7/5 starson G2Crowd

- Bank-grade 256bit SSL encryption security

- Best of all, it’s free – the only thing you have to pay for is a processing fee for accepting online payments (2.9% +$0.30 in the US, international rates here)

Wave is cloud-based accounting software which is geared towards small businesses with nine employees or fewer, and can also work for freelancers, proprietors, entrepreneurs, and online sellers (Amazon, Etsy, eBay, etc). Wave is also a popular choice for most small operations, this is not because it’s free but because it can be used easily and the interface is simple and appealing.

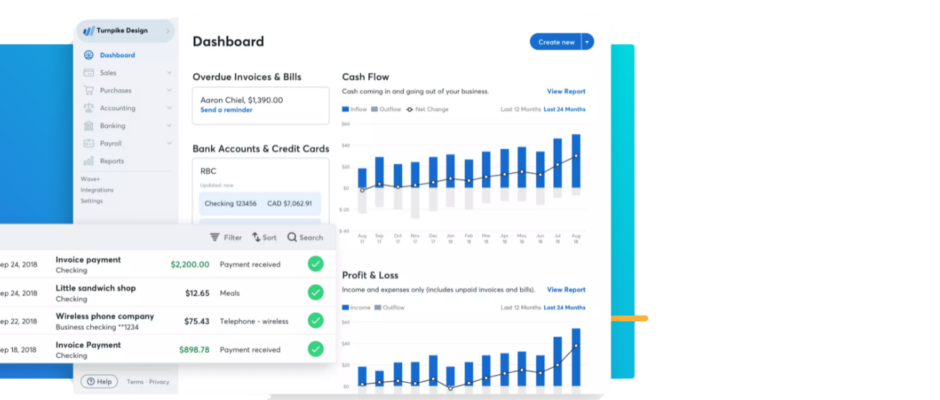

The dashboard shows a great picture of your business’s financial state with graphs which shows the Income and Expenses, Net Income, Payables and Owing as well as Business Expenses.

Wave stays competitive whereas its rivals paid accounting software with estimate, report, invoice, automatic transaction import, receipt tracking as well as contact management capabilities. And contrary to many other free software programs, Wave didn’t put any limit on invoices, estimates, reconciliations or customers. Everything is free and unlimited. Additionally, Wave also allows its users to manage multiple business pages whenever they are in need of that.

Wave is also compatible with other operating systems such as Windows, Mac, and Linus and also has mobile applications for both iPhones as well as Androids. But these applications are not complete versions like the desktop software. The Receipt by Wave application is available on both Android and iPhones, whereas the Invoice by Wave application is only available for the iPhone.

It is very easy to set-up account and only takes a few minutes, many support options are also available to speed up this process. For any set up question which you may have Wave University will provide answers to them. You Tube account have information about how to videos and a comprehensive FAQ and Community Forum. Wave likewise have email support, but this part of the company’s customer service still need improvement; free account will only receive an email answer after 2 or 3 days, however $9/monthly plans and $19/monthly plans receive a single day email responses as well as live chat. Although it is slow but the customer service is very helpful, kind and free.

Majority of the user do complain about mediocre support as well as lack of full-functioning mobile app. The current apps are not only limited, they likewise run at a slow pace and there is no certainty on when an update would be released. Other shortcomings include the limited number of integration and the lack of cash-based accounting. If you’re also running a larger company, there is high probability that Wave does not have a complete accounting capabilities needed, most especially if you’re looking for a task/project managing functions or a tax forms.

But Wave wins the title of the best free accounting software for small business who do not need these functions. It also holds its own with some paid accounting software solutions. With the presence of many features (my own favorite is beautiful, easy to make invoices), Wave is perfect for many accounting needs. Apart from saving you money, Wave will also save you time and a lot of frustration, especially for those that are not familiar with accounting.

The Runner-Up for Best Free Accounting Software: SlickPie

This is a cloud-based, double-entry accounting software which is mostly used by small businesses. SlickPie does not have much features when compared with Wave, and its version is limited to 100 invoices a month, 5000 bank reconciliations, 100 bills a month, and 5GB of document storage (but it allows unlimited users). However, the company is also growing, expanding, and they are updating their current software and may be a company to be reckoned with in few years’ time.

Highlights:

- It’s absolutely free

- Includes 100 invoices/month, 100 bills/month, 5000 bank reconciliations/month, and 5GB storage

- Unlimited users

- Beautiful interface, incredibly easy to use, perfect for non-accountants

- Open API

- Invoices are customizable with logos

- Track when your client has viewed an invoice, let customers pay directly online, and set recurring invoices and late payments reminders

- Import bank accounts, credit cards, and PayPal transactions automatically

- Includes twelve accounting reports

- Other features include journal entries, receipt management, contact overview, sales reports, and a well-organized dashboard showing you a financial overview

- Good customer service

- Integrates with 100+ banks

- 5/5 starson G2Crowd

- Bank-grade security with 256bit SSL encryption

- Inventory feature *coming soon

It was developed in August 2015, and is a little late to the cloud-based accounting game. However, for such company, SlickPie has a great potential and it’s also free, which makes it a good option for small businesses which are just starting. The software was created with the aim of providing small business owners with a simple and intuitive accounting experience that users can make use of at any time without any headaches. And I can report that there is no headache from my part.

With an amazing process which is easy to set up and a simple interface, the founder Nick Chadli was able to create software that is aesthetically appealing and unintimidating. On the dashboard, the graphs that are available include a Financial Overview, Profit and Loss, Sales Reports and Contract Overview (also noting the customer’s upcoming as well as overdue invoices). A quick link button to almost all the functions is likewise available on the right corner of the dashboard.

SlickPie also have the ability to manage contacts, create invoices and estimates, import bank transactions, manage bills, build accounting reports and also create journal entries. Additionally, at the end of the year, SlickPie likewise plan to have an inventory option available which will help to track product, services and also calculate the profits (by comparing the purchase prices and sales prices, and taxes on the product purchase and the ones sold). The update will likewise add fixed assets depreciation, and businesses will be able to offer their customers partial payment plans.

The major shortcoming of SlickPie is that they claim to have ‘mobile first’ approach but they do not offer a mobile app. Although SlickPie can be opened on a mobile device with the aid of a web browser but the mobile apps is yet to be released. However, they do not live up to expectation in this regard and they are majorly supported on traditional desktop devices as well as internet browsers.

Because the product is still new, the reviews available are few, the customer’s comments were positive, although there are some users that caution the software might not be the best for larger business, just like Wave, it does not have typical tax form functions or the kind of payroll capabilities which can be found in fuller accounting software.

SlickPie likewise come along with many important accounting features and can be used easily, and this may be enough for small businesses. The well-organized interface and the free cost make this software simple to use. It might be a good contender in years to come but now, there is need for the company to work on the shortcomings and also build enough revenue in order to create mobile apps that is very good. SlickPie is still worth monitoring and when the inventory function is added, it might be a great choice for small businesses as well as online sellers who are dependent on inventory.

Winner: Zoho Invoice

Zoho Invoice is the smaller and younger cousin of Zoho Books which is one of the Zoho Suite’s full subscriptions accounting software. However, some of the best features of Zoho Books involve invoicing, and these features have now been condensed into a different product, Zoho Invoice which is a smaller-scale program focused majorly on invoicing and is offered for free.

Highlights:

- Cloud-based software can be accessed anytime, anywhere

- Quick set-up, easy to use

- Seven professional, customizable invoice templates with recurring invoice option; send invoices by email or snail mail; accept payments directly from invoice or by cash/check

- Create estimates and convert them to invoices with a single click

- Add tasks and track time through the projects feature; easily convert timesheets into a billable invoices

- Record and track all expenses

- Manage receipts online or through mobile app

- Other features include: contact management, item management, credit notes, and sales tax functions with easy-to-set defaults

- Includes TWENTY-SEVEN financial reports

- Impressive amount of integrationsfor a Zoho Suite product, including Paypal, Stripe, and more

- Works well with existing Zoho Suite products

- Strong, highly praised mobile apps that offer the full functionality of the desktop software

- open API

- 128/256bit SSL encryption security

- It’s free – for businesses up to 25 clients and 1 user

Zoho Invoice is marketed majorly to sole proprietors and very small businesses. It also have about seven invoice templates from which you can choose from, this is a higher number when compared with other free software programs including Wave. Zoho invoice likewise goes to the extent of informing you the template that is best for the kind of invoice which you are sending (i.e. for displaying large logos, for long lists of expenses, for sending by snail mail, etc.). The template is also perfect for any program that specializes in invoices, however, they can be customized with logos, terms and agreements, and personalized notes to the customers. Payment options may also be included in the invoice design and the payment can be accepted online, by check or by cash.

Although it focuses primarily on creating an effective invoice, this software provides much more than invoicing service. Zoho Invoice likewise allows users to create an estimates, credit notes, projects and reports. Zoho Invoice likewise track payments received and expenses so that the company’s financial state can be quickly show on the dashboard.

Zoho Invoices is an application which can be accessed on almost any desktop or any device with internet connection. Both iPhones and Android app are mostly valued by the users. This application has nearly similar function with the desktop version and allows businesses to keep their work regardless of where they are. The Zoho Invoice is easy to set up and also requires a brief preferences questionnaire. It is also easy to use the interface, however some user are of the opinion that it is confusing in some cases. There are customer service options which include email and phone support, a YouTube channel, in-program live chat as well as an online help center. It is however unfortunate that most user complain about the quality of the customer service.

Before you get attached, there are some setbacks for Zoho Invoice users. In order for the service to remain free of charge, your business can only have less than 25 customers and a single user. A $7/monthly charge covers 50 customers, $15/monthly covers 500, and $30/monthly provides unlimited customers and users and you can also pay for a full accounting software at that point just like Zoho Books.

But for the business to look specifically for invoice-focused software, and who does not have up to 25 customers, it would be difficult to find good invoicing software. The feature of the project is also appealing, some paid accounting software likewise lack this function.

The Runner-Up: Invoice Ninja

It is not easy to find a lot of information about Invoice Ninja which is the runner-up for free invoicing software, which seems fit perfectly with its name. It is an open source, cloud-hosted software. Invoice Ninja has also been around since 2013 and is mostly used by freelancers and other small business owners who are in need of a quick, simple invoicing software.

Highlights:

- Open source, cloud-based software can be accessed anywhere

- Simple to use

- It’s 100% free

- Supports 100 clients and includes four invoice templates

- Offers recurring invoices and online payment options

- Integrates with over 45 payment gateways

- Manages contact information, including personalized default currencies and payment terms; offers contact archive for inactive, former clients, so you can store their important information while keeping the interface clean

- Create tasks and projects, attach them directly to invoices

- Create quotes that can also be turned into invoices

- Track expenses

- Auto-billing and auto-calculation of average invoice income and total revenue

Invoice Ninja has a simple and effective interface with everything that is necessary for invoicing. Invoice Ninja is a free invoicing option which allows up to one hundred customers, although it provides four templates rather than seven unless you subscribe to a paid monthly plan which will allow up to ten templates. The templates can be branded with logos; however each invoice is made with this software and would say “created by Invoice Ninja” unless you subscribe to the $5 monthly fee or the $50 yearly fee so as to have access to a custom URL and a custom invoice design. Your customer can also make partial or full payments directly online with any of the Invoice Ninja payment gateways.

The fee payment option also includes the recurring invoice. It also has other features which include the ability to create projects and tasks, generate quotes and estimates, calculate total revenue and also manage contracts. The total revenue with other information regarding rents, upcoming and overdue invoices can be found on the dashboard.

It can be used on any device with internet connection; it also has a self-hosted option which allows some users to recode the software in order to fit their needs. But most of the users stick to the original software and Invoice Ninja now has no mobile apps now but they are on the list of upcoming features and additional accounting reports.

One of the main shortcomings of Invoice Ninja is the lack of information regarding the business. It is very difficult to find any information online regarding the history or practices of the company, and the customer reviews are very few. This relative anonymity is not a deal breaker but it is worth keeping in mind. There is need for you to also know that as a smaller company, Invoice Ninja provide a few customer support options. What Invoice Ninja offers in terms of customer service is very helpful and include a support forum, a blog featuring how-to’s and business advice, a FAQ section, a user guide for set up, as well as a direct email support.

Invoice is also a viable option for small company. In fact they beat Zoho Invoice when it comes to integrations, and allows users to have four times as many customers. However, the feature depth is limited when compared to Zoho Invoice and the company is less reliable than other known competitor.

Final Verdict

So which one of the free bookkeeping tools is most helpful for your business? If you want full accounting software, Wave is the best choice, if you are the type that wants strong invoicing features; Zoho Invoice is an amazing option. Although neither of the software is perfect and many lack a few features which are very crucial for larger business. For the small companies who do not need many features and would like to keep the interface as clean as possible, SlickPie and Invoice Ninja can be a good choice. Although these two bookkeeping solutions are outranked by the category winners, both offer some features which is not present in Wave and Zoho Invoice. SlickPie may be a great option for companies that are looking for project or task management. Companies that have more than 25 clients with multiple users, Invoice Ninja would be very effective.

Try one or all these programs and see if they are good for your business. There is nothing for you to lose since they are all free.